There are now apps for practically every concern, and the selection of apps for personal finance is just as vast. If you have a specific financial need or goal, take a look at some of our app suggestions that will help you address these. The solution to your money concerns may rest in the palm of your hand.

You Need A Budget (YNAB): Financial Literacy

One of the most important steps to reaching financial stability is being knowledgeable about financial concepts – What’s the difference between Cryptocurrency vs. Regular Currency? What is a hard inquiry? What is the best way to save my money? You need to educate yourself to be able to make good financial choices. If you’re looking for a basic understanding of financial concepts, YNAB features online classes and webinars with live instructors who can answer all your questions about budgeting basics and other financial woes.

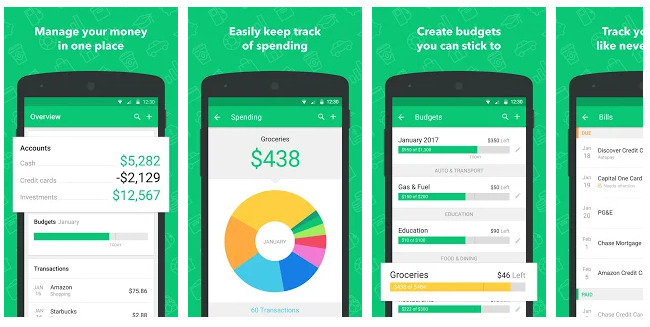

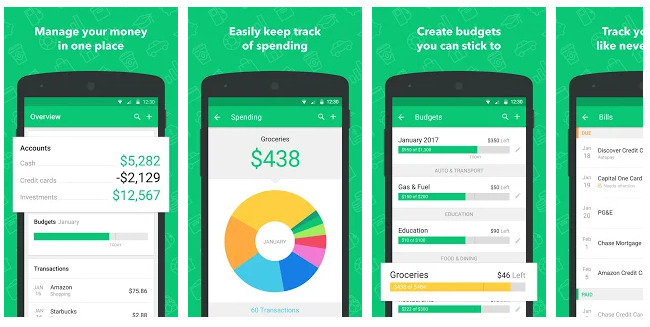

Mint: Tracking Expenses

It is very easy to lose track of your finances. For those who want to be conscious about their money, Petal Card explains that one of the best financial habits you can build is tracking your spending. Keeping track of your expenses requires transparency in recording even the smallest purchases to hold yourself accountable. Apps like Mint help you get an idea of your average spending habits, then suggest budgets for each category, for which you can make the necessary adjustments afterwards.

Splitwise: Paying debts

Lending or borrowing money from your friends is a normal occurrence, but leaving minor debt hanging around is never a good habit. Bustle featured a consumer behaviour study that found that 65% of women want to get paid back immediately after spotting a bill or sharing a purchase. Since failure to pay someone back could put a strain on your relationship, Splitwise was created to ensure that this will not happen. You can even adjust how you want bills so be split and it even syncs with P2P app Venmo to make money transfers more seamless.

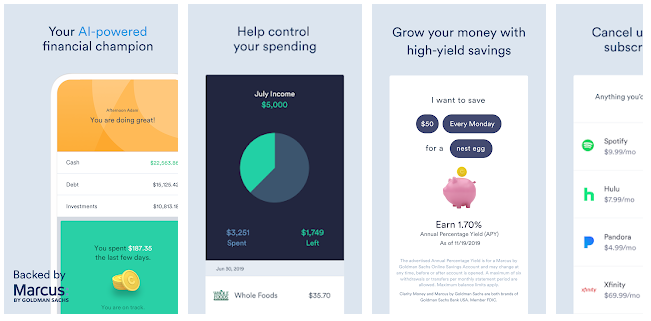

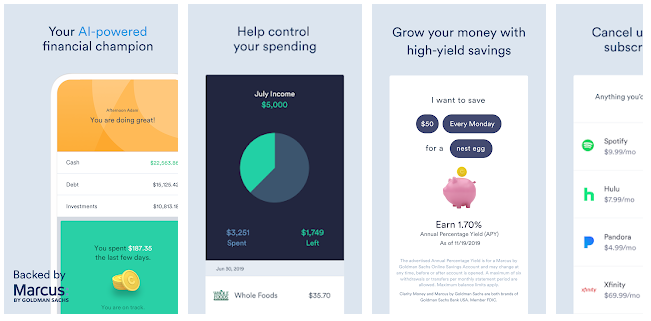

Clarity: Bill Management

Janet Stanzak of Financial Empowerment says that while setting your bills on autopay is convenient, it makes money flowing in and out of your account a little too easy. You may forget to keep track of where that money is. If you must set up autopay, apps like Clarity centralize your expense tracking, including your subscription bills. You can easily find and cancel unwanted subscriptions, and be reminded of where exactly your money is going every month. All you have to do is link your different financial accounts and it will do most of the work for you.

Betterment: Investing

Once you have mastered the art of saving, you may start to think about where you can put your money to watch it grow. Financial planner Eric Roberge says that diversifying your portfolio and where you invest are some of the simplest ways to ensure you’ll have enough saved for the future. Betterment guides you in managing your money while also creating savings accounts for retirement. You can even seek advice from licensed financial experts about your accounts. There is no minimum investment required.

When it comes to managing your finances, there’s no better time to be addressing this than right now. Head over to your app store and hit ‘download’ as soon as you can!

Add comment